Hurricanes are a fact of life in Florida, especially in places like Fort Myers. When a storm hits, your focus should be on staying safe—not worrying about whether your homeowners insurance will cover the damage. Understanding Hurricane Damage Coverage is key. It helps ensure you’re prepared before the storms arrive. Let’s break it down together.

Understanding Hurricane Coverage in Homeowners Insurance

What Is Covered Under Standard Homeowners Insurance Policies?

When hurricanes hit, your homeowners insurance can help cover certain types of damage. However, it’s important to know what’s included in your policy. Here’s a breakdown of what’s typically covered under standard homeowners insurance:

- Structural Damage – Standard policies usually cover repairs to your home’s structure, including the roof, walls, and foundation, as long as the damage is caused directly by the hurricane’s wind. According to Rutgers University, wind damage accounts for over 50% of all insured hurricane losses.

- Personal Belongings – Items like furniture, clothing, and electronics are usually covered. However, the coverage limits may vary, so be sure to check your policy.

- Additional Living Expenses (ALE) – If your home becomes uninhabitable, your policy can cover hotel stays, food, and other temporary living costs.

Understanding the details of your homeowners insurance ensures you aren’t caught off guard when filing a claim for hurricane damage.

What Is NOT Covered by Standard Policies?

While homeowners insurance provides crucial protection, it doesn’t cover everything. This is an area where many homeowners misunderstand their coverage. Things typically not covered include:

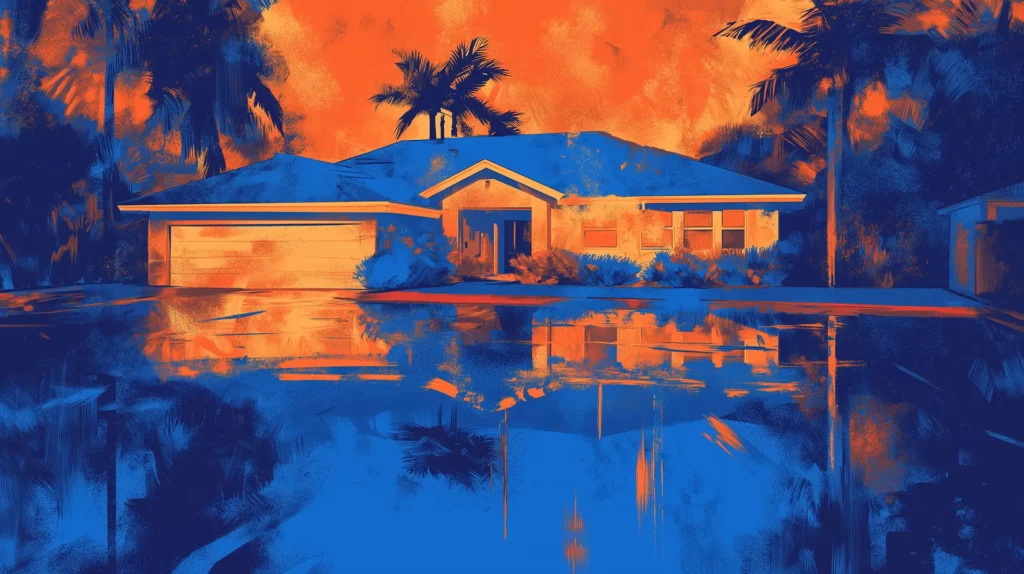

- Flood Damage – Most policies exclude damage from rising water or storm surges. FEMA reports that just one inch of floodwater can cost $25,000 in home repairs.

- Storm Surges – These are also categorized as flooding and require separate flood insurance.

- Earthquake-Related Issues – Rare during hurricanes but still worth noting, as earthquake damage is not covered under standard policies.

If you’re unsure whether your damage is classified as flood or wind-related, speak with your insurer. Properly understanding Hurricane Damage Coverage can save you major financial headaches when a storm strikes.

Special Considerations in Florida

Florida has its own challenges when it comes to Hurricane Damage Coverage. You’re dealing with unique risks tied to living in a hurricane-prone area. Coastal areas like Fort Myers often face storm surges, massive winds, and flooding.

- Fort Myers Hurricane Risk – On average, Florida experiences about 40% of all U.S. hurricanes. Fort Myers is no stranger to hurricanes, with Hurricane Ian causing $112 billion in damages in 2022 alone.

- Why You Should Review Coverage – The severity and frequency of hurricanes here make it vital to review your policy annually. Overlooking exclusions or gaps in your coverage could leave you thousands of dollars short when disaster strikes.

By understanding what’s covered and what isn’t, as well as the unique risks in Florida, you can take proactive steps to protect your home. Hurricane Damage Coverage is only as strong as your knowledge of your policy. Make it a priority to read the fine print. Now, let’s look at hurricane deductibles and how they impact your claims.

The Role of Hurricane Deductibles

What Are Hurricane Deductibles?

When it comes to Hurricane Damage Coverage, understanding deductibles is crucial. A hurricane deductible is what you’ll pay out of pocket before your insurance kicks in after a storm. It’s specific to damage caused by official hurricanes, as declared by the National Weather Service.

Hurricane deductibles are different from regular insurance deductibles. They are typically higher and designed to help insurers manage the high cost of widespread damage during major storms. For example, if your home is insured for $300,000 and your hurricane deductible is 5%, you’ll need to pay $15,000 before your insurer covers the rest.

The key is to know when this deductible is triggered. Once a hurricane is declared by authorities and the damage is related to that storm, hurricane deductibles apply.

How Are Deductibles Calculated?

Hurricane deductibles are often percentage-based, not fixed dollar amounts. They’re based on the insured value of your home. Here’s a quick breakdown:

- 2% Deductible for a $200,000 Home – You would owe $4,000 before your insurance coverage begins.

- 5% Deductible for a $400,000 Home – You’d pay $20,000 out of pocket.

These costs can add up quickly, so it’s important to calculate your potential out-of-pocket costs before hurricane season begins. According to the Insurance Information Institute, these deductibles are common in hurricane-prone areas like Florida, including Fort Myers.

Tips for Managing Hurricane Deductibles

To make sure you’re ready financially, here are some practical tips:

- Review Your Policy – Check your current deductible percentage. Would it strain your budget in an emergency?

- Adjust if Necessary – Some insurers allow you to change your deductible. A higher deductible can lower your premium, but only choose one you could comfortably afford during a claim.

- Set Aside Savings – Have a hurricane-specific emergency fund to cover your deductible. This can prevent financial stress when storms hit.

Being proactive about hurricane deductibles gives you a clearer understanding of Hurricane Damage Coverage. Now, it’s time to explore why flood insurance matters for Florida homeowners.

The Importance of Flood Insurance

Why Flooding Isn’t Covered in Standard Homeowners Policies

Many homeowners are surprised to learn that standard policies don’t cover flooding. Even during a hurricane, flooding is classified separately from wind damage. For example:

- Flooding from Rising Water – If heavy rain or storm surges cause water to rise and damage your home, standard Hurricane Damage Coverage won’t apply.

- The Risk Factor – FEMA states that floods are the most common and costly natural disaster in the U.S., with $43 billion in damages over the last 10 years.

This makes having flood insurance critical, especially for Fort Myers homeowners where hurricanes often bring storm surges.

What Does Flood Insurance Cover?

Flood insurance steps in to cover damage that standard policies leave out. Here’s what it typically includes:

- Structural Damage – Covers damage to your foundation, walls, and electrical systems caused by rising water.

- Personal Property – Protects belongings like furniture, appliances, and clothing up to specific limits.

- Clean-Up Costs – Helps with removing debris and addressing water damage to your home.

It’s important to know there are coverage limits, especially on expensive items. Review your policy to understand what’s protected.

How to Obtain Flood Insurance

You have two main options for purchasing flood insurance:

- NFIP (National Flood Insurance Program) – A government-backed program that provides coverage for most homes in the U.S. Flood premiums for homes in high-risk areas like Fort Myers can range from $500 to $3,000 annually, depending on your home’s specific risk.

- Private Insurance Providers – These often offer higher coverage limits and competitive rates, which may be a better fit if your property’s value exceeds NFIP’s cap.

Before buying a policy, evaluate your flood risk. FEMA’s Flood Map Service shows whether your home is in a high-risk flood zone. Since Hurricane Damage Coverage won’t handle flood-related claims, having flood insurance is an important safeguard for homeowners in hurricane-prone areas.

Understanding and adding flood insurance to your policy gives you a more complete safety net. Next, we’ll go over what steps to take after your home is damaged by a hurricane.

Steps to Take When a Hurricane Damages Your Home

Immediate Actions After the Storm

When the storm passes, your first steps are the most important. Focus on safety and documenting the damage. Here’s what you should do:

- Ensure Safety – Don’t enter your home if it’s unsafe. Watch for downed power lines, gas leaks, or standing water.

- Document the Damage – Take photos and videos of everything. Include structural damage, destroyed belongings, and water intrusion. This creates a strong record for your Hurricane Damage Coverage claim.

- Prevent Further Damage – If it’s safe, take steps to stop additional destruction. Tarp a leaking roof or board up broken windows. Keep receipts for materials. Some policies require you to take reasonable action to limit damage.

Being prepared helps streamline the entire claims process.

Filing an Insurance Claim

Once you address the immediate issues, it’s time to file your claim. Follow these steps:

- Contact Your Insurer – Call your insurance company as soon as possible. Many have 24/7 hotlines for disaster situations.

- Provide Evidence – Share all the photos and videos you’ve documented. Include a written list of damages and any receipts for temporary repairs.

- Work With an Adjuster – Your insurer will send an adjuster to inspect your home. Be sure to point out all areas of damage during the visit.

According to the Insurance Information Institute, filing your claim early can speed up the process. After a major hurricane, insurers often deal with thousands of claims at once, so don’t delay.

Navigating Disputes or Denied Claims

Unfortunately, disputes can happen. Here’s how to handle them:

- Understand the Denial – If your claim is denied, request a written explanation. This will outline why and give you a basis for appealing.

- Provide Additional Evidence – If needed, gather more detailed documentation to support your case.

- Get Help – Sometimes disputes require professional guidance. You can consult a public adjuster or even an attorney to challenge unfair decisions.

Hurricanes are stressful enough without having to fight for coverage. Preparing in advance and documenting thoroughly can reduce your chances of encountering claim issues.

Knowing what to do after damage gives you a clear path forward. Next, we’ll discuss how Fort Myers homeowners can prepare for hurricane season before disaster strikes.

Tips for Fort Myers Homeowners in Hurricane-Prone Areas

Preparing Your Home Before Hurricane Season

Preparing your home before hurricane season can save you money and stress. Here are some practical ways to fortify your property:

- Reinforce Your Roof, Windows, and Doors – Did you know that roofs are one of the most vulnerable parts of your home during hurricanes? According to the Insurance Institute for Business & Home Safety, wind-resistant roofs can reduce hurricane damage by up to 85%.

- Install Hurricane Shutters – These protect your windows from flying debris. If shutters aren’t an option, use plywood as a temporary alternative.

- Trim Trees and Secure Outdoor Items – Branches can break during high winds and cause severe damage. Clear your yard of objects like patio furniture, which could turn into projectiles.

- Check Your Drainage – Make sure gutters and downspouts are clear. Proper drainage can prevent water from pooling and flooding your home.

These proactive steps help minimize potential damage and ensure your Hurricane Damage Coverage can focus on what’s unavoidable.

Reviewing and Updating Your Insurance Policies

Even the best preparation can’t stop every hurricane, which makes the right insurance essential. Here’s how to ensure your coverage is ready:

- Schedule an Annual Review – Policies can change, and so can your needs. Sit down with your agent once a year to confirm you have adequate Hurricane Damage Coverage.

- Add Flood Insurance – If you don’t already have it, consider it. Flooding is not covered by standard homeowners insurance, but FEMA reports that those in high-risk areas have a 25% chance of flooding during a 30-year mortgage.

- Understand Exclusions – Carefully read your policy to know what’s covered and what isn’t. Look for endorsements that offer extra protection, like for windstorm damage.

An updated policy ensures you’re financially prepared for hurricane season.

Staying Informed During Hurricane Season

Finally, staying informed is one of your greatest tools during hurricane season. Here are key steps:

- Monitor Weather Alerts – Download weather apps or tune into local news for updates on approaching storms.

- Sign Up for Notifications – Fort Myers offers emergency alert systems to keep residents informed during hurricane events. Don’t miss out on critical updates.

- Know Your Evacuation Routes – If an evacuation is ordered, you don’t want to scramble. Have a plan in place, including alternate routes to avoid congested areas.

Taking charge of your safety keeps you one step ahead, even when hurricanes are unpredictable.

By combining preparation, insurance policy updates, and staying informed, you can face hurricane season with confidence. All of these steps work together to complement your Hurricane Damage Coverage and protect your home and family.

When it comes to hurricanes, understanding your homeowners insurance can make all the difference. We’ve covered the essentials of Hurricane Damage Coverage, from what standard policies include to what they exclude, like flooding. We broke down how hurricane deductibles work and why knowing your costs upfront matters. We also explained the importance of adding flood insurance and how to strengthen your home and plans before hurricane season.

Don’t wait until a storm is on the horizon. Reach out to us today to review your insurance, make updates, and ensure you’re fully prepared. Contact our team in Fort Myers for expert advice or to get a personalized quote.